Bend Park and Recreation District

- fitness & swim

-

- parks & trails

-

-

Work for BPRD

Work for BPRD

Work for BPRD

-

- activities

-

-

By Category (A-M)

-

- facilities

-

- about

-

-

- Contact Information

- How To Register

- Air Quality and Operations

- Delays and Cancellations Report

- Accessibility

- Advancing Diversity, Equity and Inclusion (DEI)

- Board of Directors & Meeting Info

- Lost and Found

- Recreation Scholarships

- Servicios en Español

- Planning and Development

- Employment

- Volunteer with BPRD

- Public Health Advisory: COVID-19

-

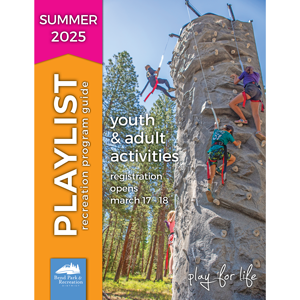

Playlist

Playlist Calendar

Calendar Board

Board News

News Jobs

Jobs Volunteer

Volunteer

- Register

- Overview

- Features

- Fees

- Rules

- Schedules & Events

- Swimming

- Fitness

- Parties & Rentals

- Childcare

- Pool Cover Update

- Contact Information

- How To Register

- Air Quality and Operations

- Delays and Cancellations Report

- Accessibility

- Advancing Diversity, Equity and Inclusion (DEI)

- Board of Directors & Meeting Info

- Lost and Found

- Recreation Scholarships

- Servicios en Español

- Planning and Development

- Employment

- Volunteer with BPRD

- Public Health Advisory: COVID-19

- home

- job descriptions

- Accounting Specialist

Accounting Specialist

Summer Playlist

Class Title: Accounting Specialist

Class Code: ACCT SPEC

Hourly: $25.26 - $33.41 | Monthly: $4378.66 - $5790.96 | Annually: $52543.95 - $69491.46Benefits: Full-time

OVERVIEW:

This classification is responsible for administering and coordinating the accounts payable functions for the District that includes accounts payable functions, other accounting responsibilities, and acts as backup to Payroll Specialist. Assists Finance Manager with a variety of accounting functions, including general ledger transactions. Assist with various administrative and data entry functions.

DISTINGUISHING CHARACTERISTICS:

The Accounting Specialist classification is distinguished from the Payroll Specialist classification as the Accounting Specialist classification has more specialized knowledge in accounting and financial principles while the Payroll Specialist is more specialized in payroll practices and principles. The Payroll Specialist also has a higher-level of complexity and accountability in the assigned duties requiring more independent judgement.

SUPERVISION RECEIVED:

Receives general supervision from the Finance Manager. Follows standard processes and procedures without supervision but confirms changes to standard practices and significant decisions in advance.

SUPERVISION EXERCISED:

Supervision is not normally a responsibility of this classification; however, may provide guidance to District staff and vendors.

EXAMPLES OF DUTIES:

The information provided below encompasses the typical duties and capabilities linked with this classification. Duties may include, but are not limited to the following:

- Evaluates the effectiveness and efficiency of the accounts payable program and recommends modifications as necessary to increase success and ensure compliance with laws and internal policies.

- Receives, verifies, processes, and calculates a variety of receipts, bills, invoices, statements, travel and expense reimbursements, new account information, claims information, payments, fees, and/or other related information, which may include coding data, entering information into software and databases, processing transactions and changes, ensuring transactions comply with established policies and procedures, running reports, filing paperwork, and performing other related duties.

- Ensures internal controls by examining and verifying all documents comply with the proper accounting policies and procedures; ensures resolution of discrepancies and errors with appropriate staff.

- Prepares checks for processing; prints and disseminates checks as appropriate.

- Prepares, reviews, and processes year-end 1099 statements; prepares related reports for dissemination to applicable state and federal agencies.

- Enters accounts payable disbursements and daily cash receipts on the banking spreadsheet.

- Monitors ending bank balance, manages banking spreadsheets, and communicates need for transfers.

- Monitors the general ledger, performs reconciliations, prepares and posts journal entries to reclassify expenditures and/or revenues to correct discrepancies.

- Coordinates and maintains the purchasing card program including ordering new purchasing cards, training staff on proper usage and monthly reporting, maintaining program records, reviewing and processing monthly transactions, and making timely ACH payment.

- Supports implementation and operates an electronic accounts payable workflow and document retention system. Develops work flow processes; transitions systems from paper to electronic; maintains integrity of electronic file systems; scans, files, purges, archives, and organizes accounting filing system; and trains staff on the use of the electronic filing system.

- Assigns general ledger and project coding to invoices and pay applications; enters information into project budget spreadsheets.

- Posts daily cash receipts to general ledger software utilizing an electronic import between two software systems. May involve analyzing, researching, correcting, balancing, and manually inputting data into the general ledger software.

- Performs payroll functions, including preparing termination checks, generating documentation and transmitting payroll taxes, requesting edits to Personnel Action forms, and backing-up the Payroll Specialist.

- Assists with contract documentation, e.g., insurance, W-9, etc., and record management.

- Researches, analyzes, resolves, and responds to various employee, department, management, and vendor inquiries.

- Performs various administrative duties, including data entry, filing, photocopying, etc., as requested.

- Acts as a Mandatory Reporter; reports incidents of child abuse/neglect.

- Performs other job-related duties as assigned.

KNOWLEDGE, SKILL, AND ABILITY REQUIREMENTS:

The individual in this classification is expected to possess and exhibit the following knowledge, skills and abilities.

Strong Knowledge of:

- General office practices and procedures;

- Generally accepted accounting practices, including financial period recognition, matching principles, and accounts payable/accounts receivable processes;

- Basic payroll processing practices; and

- Financial information systems, and computer programs and software for accounting and accounts payable system.

Skill and Ability to:

- Compute, analyze, and interpret numerical data for purposes of analyzing and drawing local conclusions on data;

- Interpret and apply the principles, laws and District procedures involved in financial recordkeeping and accounting functions;

- Organizes and prioritizes own work in a setting with frequent and rapid priority and assignment changes and additions coming from multiple perform sources in a fast-paced environment, while maintaining accuracy and attention to detail;

- Treat confidential information gained through employment with the District with sensitivity and tact;

- Proficiently operate office equipment and computer programs, including database and/or information management systems;

- Understand, remember, and communicate routine and complex, factual and financial information;

- Perform work accurately with high attention to detail;

- Effectively communicate with others verbally and in writing, including by phone, e-mail or in person;

- Convert involved technical and legal information into practical communications;

- Work independently with minimum direction, use good judgement and initiative; and

- Create positive, constructive and respectful relationships with staff and the general public.

QUALIFICATIONS:

The following are minimum qualifications for this classification.

Education, Experience, and Training:

- Associate’s degree or equivalent college coursework; AND

- Two (2) years of accounting experience; OR

- Any satisfactory combination of education, experience and training.

WORKING CONDITIONS:

The following are working conditions, including environmental and physical demands, required for this classification.

- Exerting up to 20 pounds of force occasionally and/or up to 10 pounds of force frequently, to lift, carry, push, pull or otherwise move objects.

- Remain in a stationary position (sitting or standing) for extended periods of time, move about the office occasionally.

- Expressing or exchanging ideas by means of the spoken word; those activities where detailed or important spoken instructions must be conveyed to other works accurately, loudly or quickly.

- Perceiving the nature of sounds at normal speaking levels with or without correction and having the ability to receive detailed information through oral communication and making fine discriminations in sound.

- Making substantial movements (motions) of the wrists, hands, and/or fingers.

- Ability to have clarity of vision at 20 inches or less.

- Ability to maintain sustained concentration on computer screens; use keyboards and a variety of peripherals.

- Ability to work and maintain focus in a work environment with moderate noise (i.e., working around others making periodic phone calls or having conversations) and with frequent interruptions.

- Requires crouching, bending, kneeling or reaching to perform filing activities

STATUS:

Non-Exempt

Full time

Benefits: Full-time

Current Job Opportunities